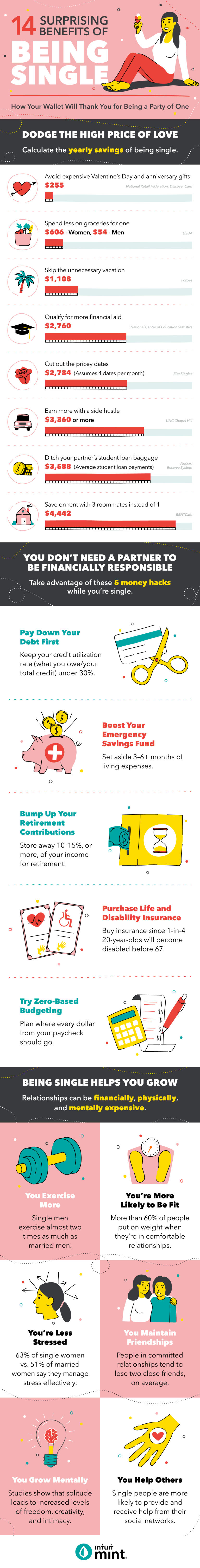

It can be hard being single, especially when Valentine’s Day rolls around, and you see others celebrating their relationships. It’s equally difficult when TV shows and movies portray relationships as the gold standard that everyone should strive for.

The truth is that being a party of one comes with plenty of benefits. You have more time to figure out who you are and who you want to be. Spontaneity comes easily because you don’t have to consider what your partner wants. You may even pick up an interesting new hobby.

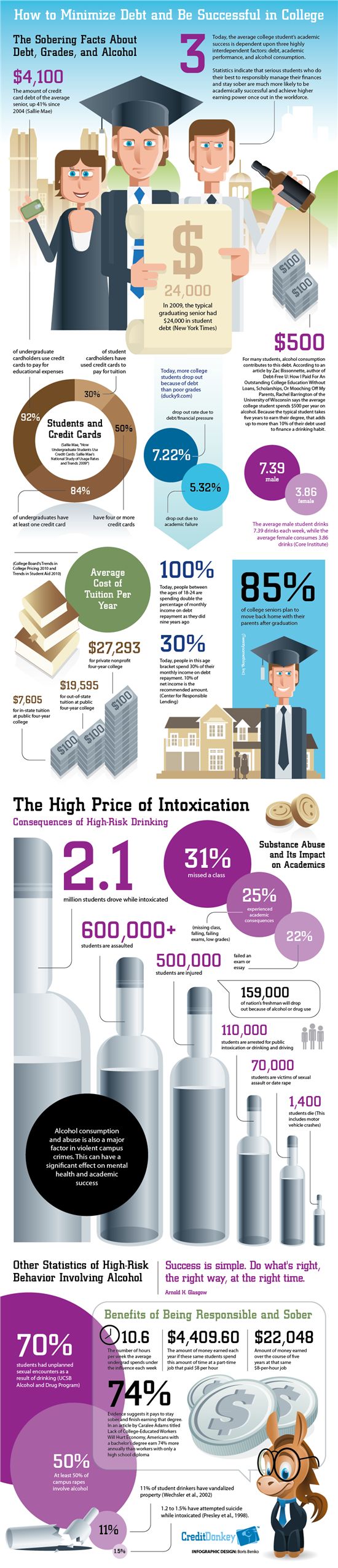

One of the best benefits of being single is the opportunity to whip your finances into shape and save a ton of money! For example, consider your monthly grocery budget. The United States Department of Agriculture estimates that the monthly cost of groceries for women under 50 is about $256. For men under 50, it’s about $302. Meanwhile, the monthly grocery cost for families of two is about $613.

Let’s do some quick math. That means each partner winds up paying about $307 per month. That’s $51 more than a single woman would pay for groceries each month and $5 more per month for men. (That’s not to mention that, if you’re single, you’ll likely spend a lot less on going out for food!)

Additionally, if you’re not in a relationship, you can live simply, take up a side hustle, and even qualify for more financial aid than you would if you had a partner.

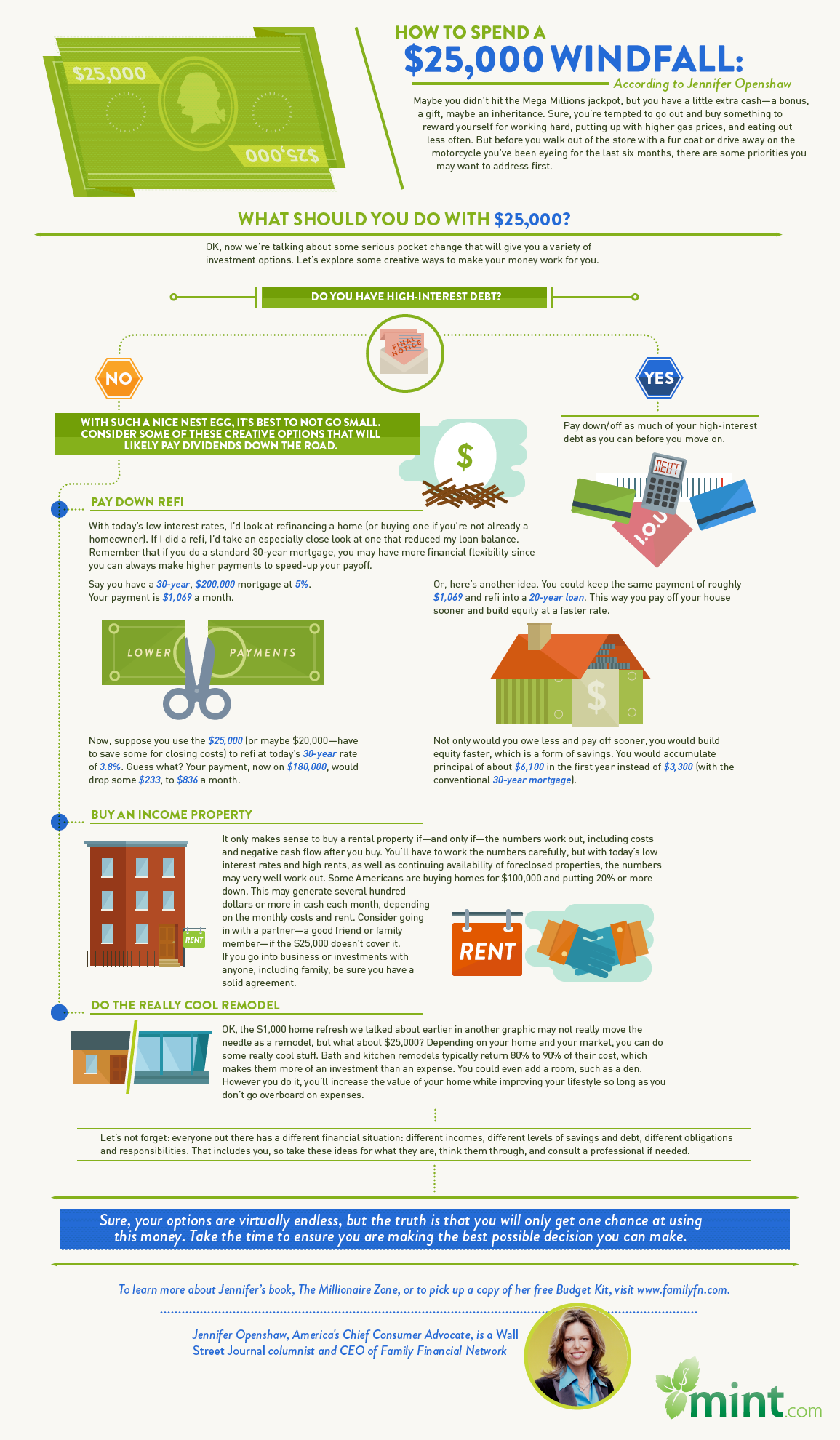

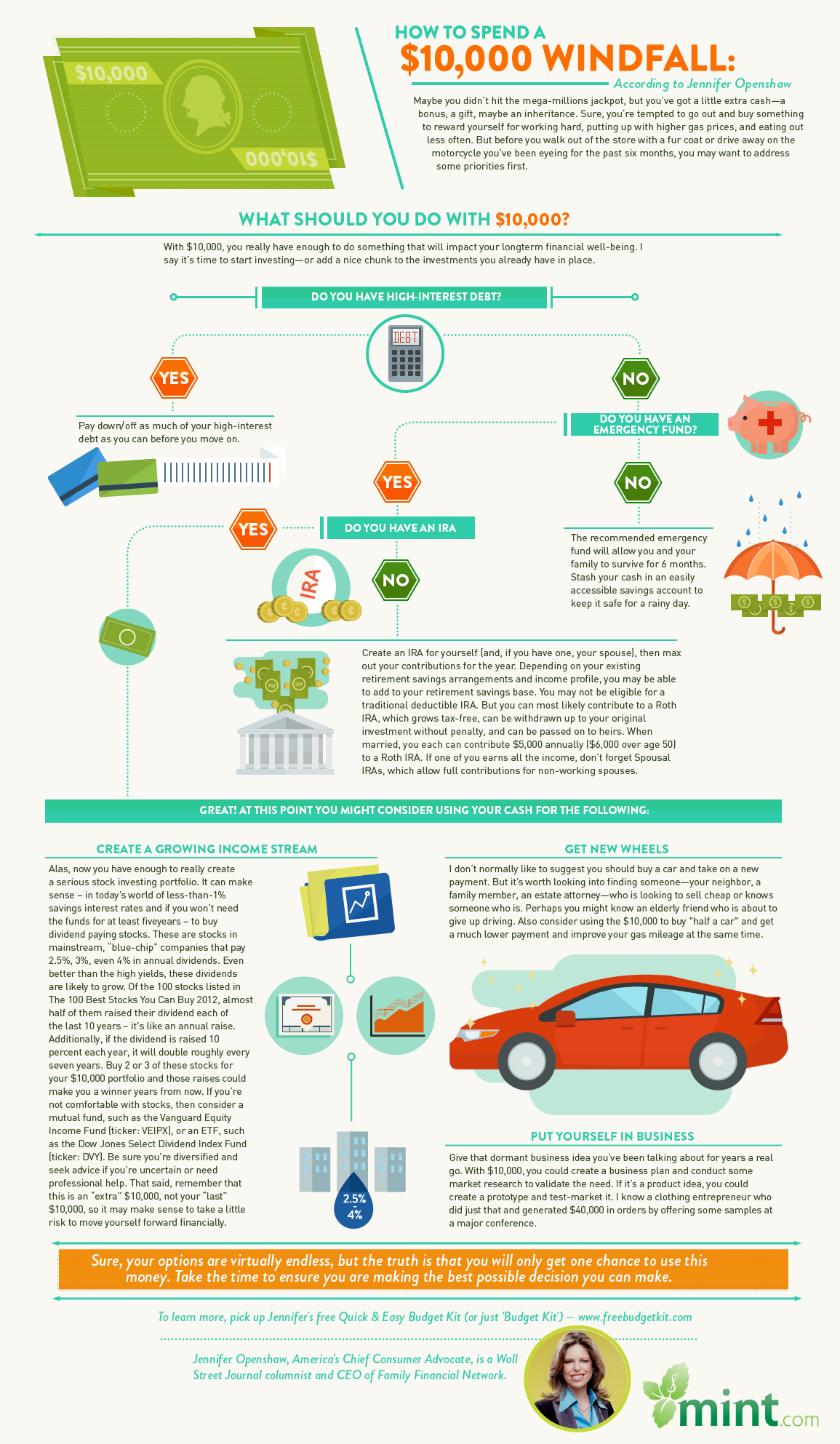

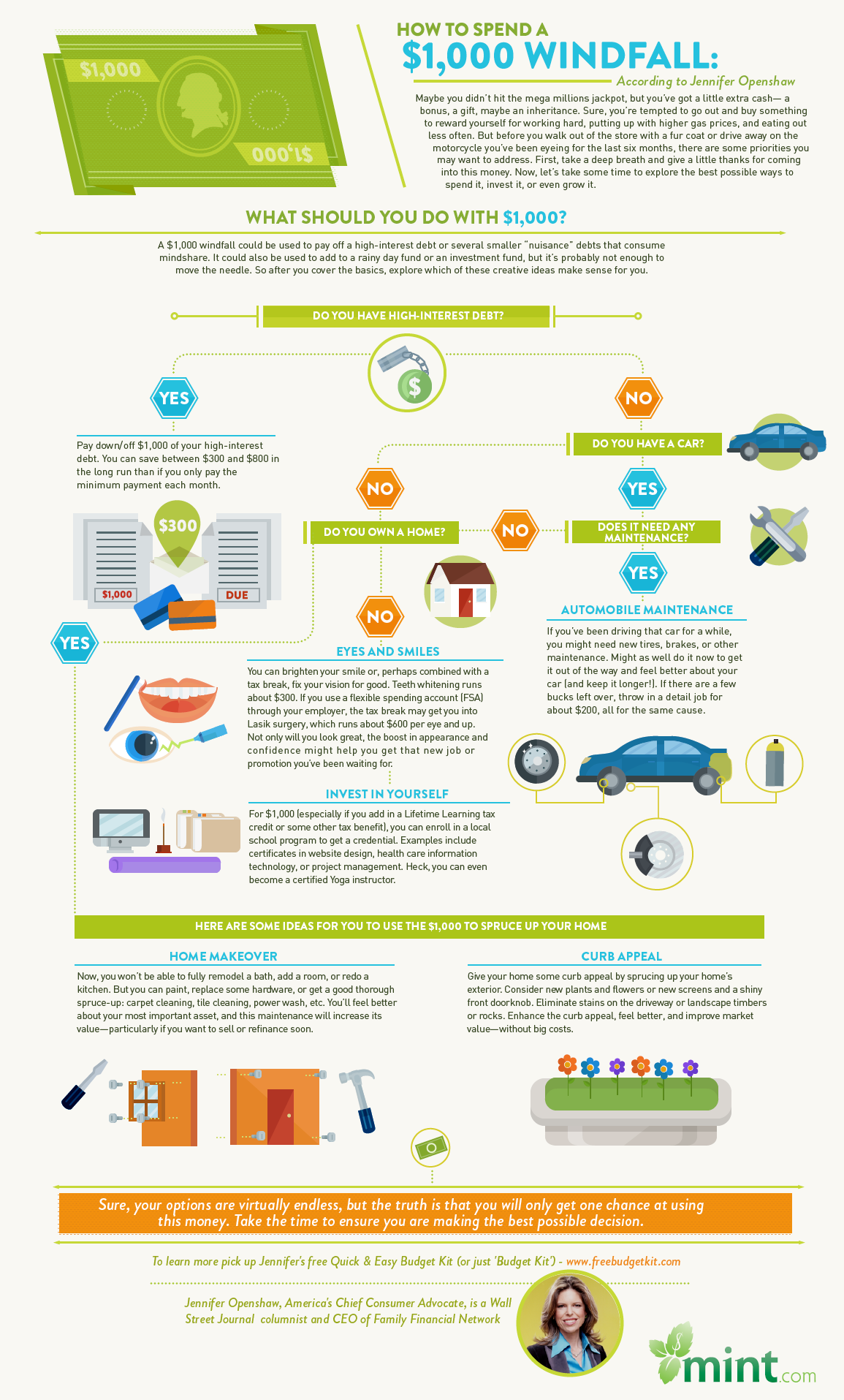

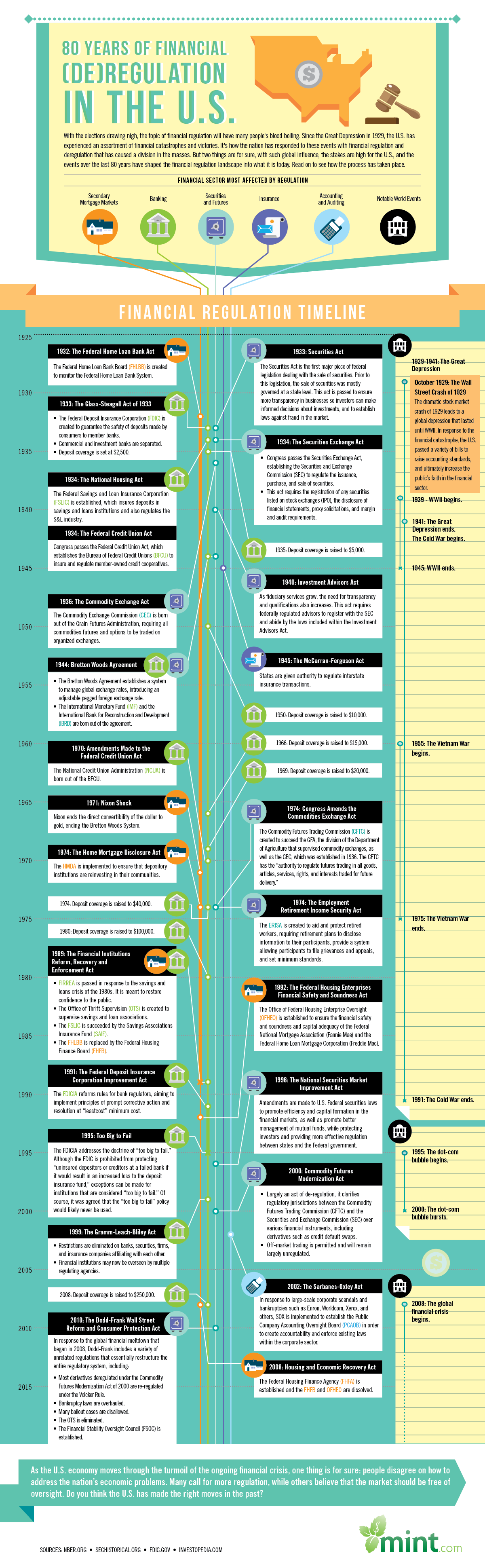

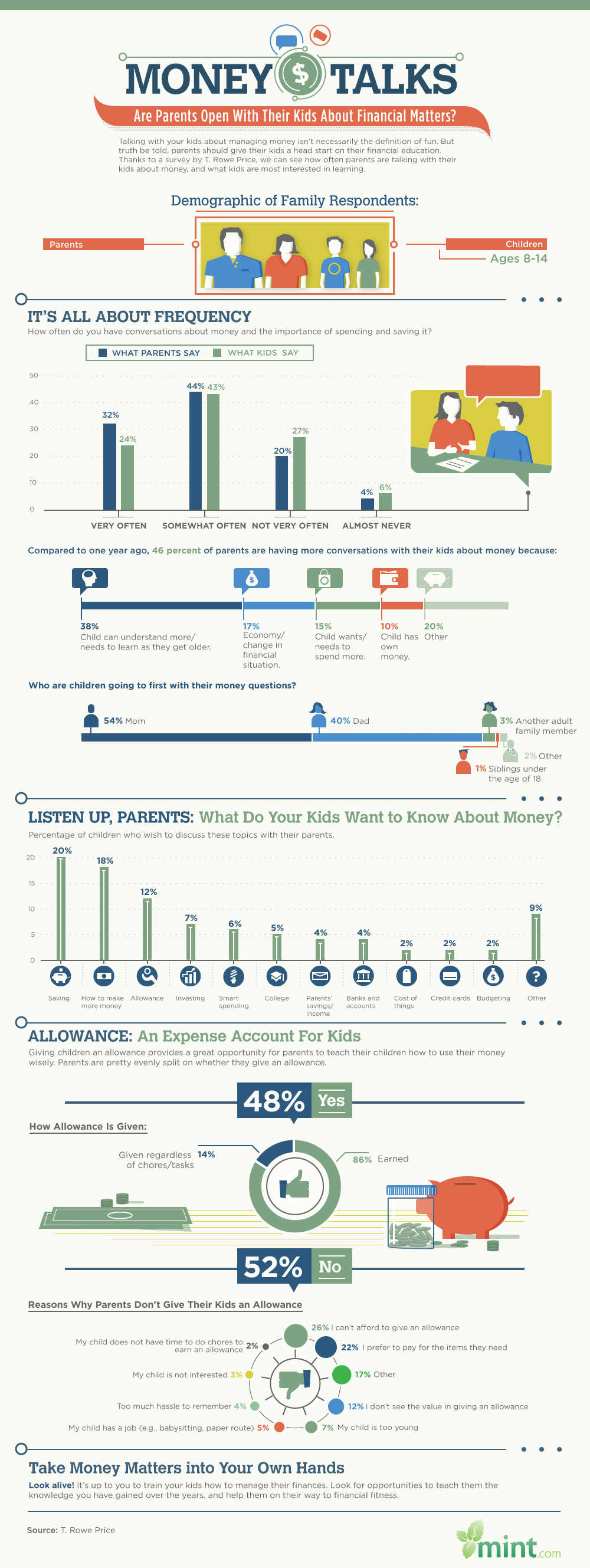

Infographic Source:- mint.com